Article Content

One of the first things suspicious brokers say is simple and confident: “We are fully regulated.” For many users, this sounds like a guarantee of safety. Regulation feels official, serious, and trustworthy. Unfortunately, in 2026, fake licenses and misleading regulatory claims are one of the most common tools used by investment scammers.

The good news is this: you don’t need legal expertise or hours of research to check a broker’s regulation. In most cases, 10 minutes is enough — if you know what to look for.

This guide explains how fake licenses work, how scammers manipulate regulation claims, and how to verify brokers step by step using real regulators.

Regulation creates trust faster than performance, reviews, or marketing. Scammers know this well.

Instead of proving real trading activity, they simply:

Many fake brokers are visually convincing. Their websites look professional, documents are polished, and “regulation” is mentioned repeatedly — often without details. Most users never verify these claims. Scammers rely on that.

The most common tactics include:

A key rule to remember: a real broker never hides its legal entity details.

Even real regulation does not guarantee:

However, fake regulation guarantees danger. Your task is not to decide whether a regulator is “good,” but to confirm:

Let’s look at how to do this with real regulators.

The Financial Conduct Authority (FCA) is one of the most respected regulators globally and one of the most abused by scammers.

How to verify:

Red flags:

If the website you’re using is not listed exactly — it’s not the same company.

The Australian Securities and Investments Commission (ASIC) regulates licensed financial services providers.

How to verify:

Common trick:

Scammers often list an ASIC company number but offer services the license does not cover, such as CFDs or retail trading without permission.

The Cyprus Securities and Exchange Commission (CySEC) regulates many EU brokers.

How to verify:

Warning:

Many scam platforms claim “EU regulation” without specifying CySEC — or use expired or suspended licenses.

This is where most confusion happens, and scammers exploit it aggressively. Important truth is that there is no single U.S. regulator for all brokers. Each regulator covers different activities.

Regulates:

Does NOT regulate:

Check using SEC IAPD (adviserinfo.sec.gov) or EDGAR (sec.gov/edgar/search) databases.

Common scam claim: “SEC registered” — without proof of authorization.

Regulates:

You can’t directly find a “broker list” on the CFTC site the way you can with FCA or ASIC. However, you can use the CFTC database to check for:

If a broker claims it is regulated by the CFTC, but there is no evidence of registration or authorization, that should be a major red flag.

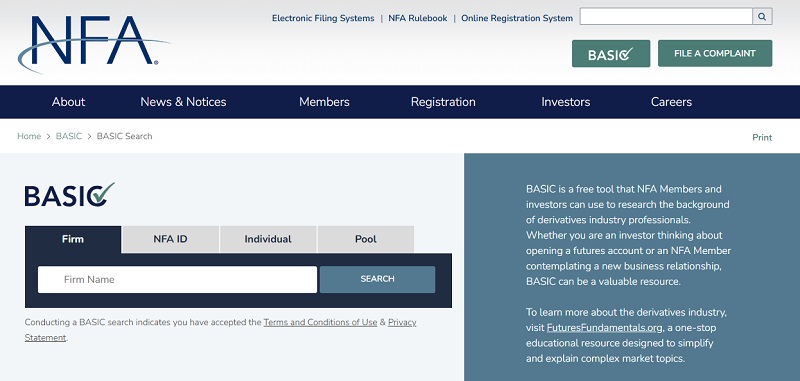

Any broker claiming U.S. forex or futures regulation must be listed in NFA BASIC.

How to verify:

If a broker claims “U.S. regulated” but is not in NFA — it is almost always a scam.

Watch for these warning signs:

Legitimate brokers expect users to verify them. Scammers avoid it.

If verification fails:

If money was already sent, this information becomes critical evidence for disputes or chargeback analysis.

Fake regulation is not a technical trick — it’s a psychological one. Scammers don’t rely on complexity. They rely on assumptions. You don’t need to trust promises, documents, or “support managers.” You only need one thing: independent verification.

Ten minutes can save you years of stress — and thousands of dollars.