Article Content

At first, everything looks harmless. You receive a message offering simple online work: liking posts, completing small tasks, helping promote apps or products. No experience needed, flexible hours, fast payments. Sometimes you even get paid on the first day.

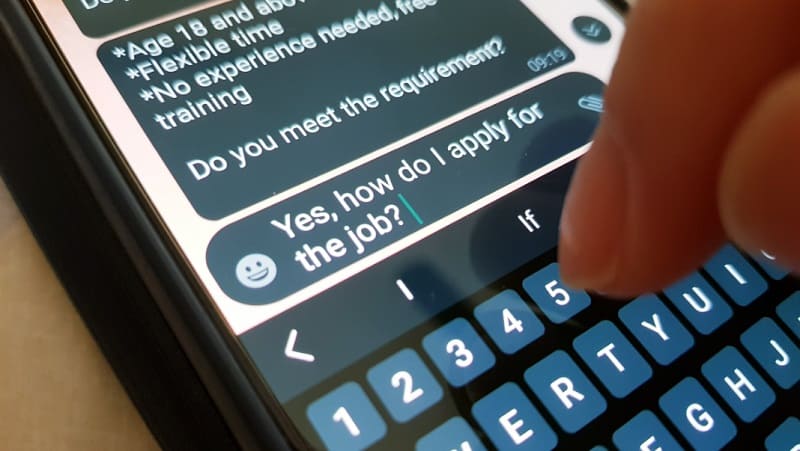

Often, the message comes through Telegram, WhatsApp, Instagram, or even LinkedIn. It may look like a personal invitation or a job referral. The sender sounds polite, professional, and relaxed — nothing like a scammer.

That’s exactly why affiliate and task scams are so dangerous — they don’t look like scams at all. They feel like an easy side job. And by the time something feels off, the trap is already closed.

Task scams are schemes where victims are paid for small, repetitive actions: likes, reviews, clicks, bookings, or app installs. The tasks look real, the payments are small but fast, and the platform often looks professional — with dashboards, support chats, and “earnings” pages.

In many cases, the first few tasks actually pay out real money. This is intentional. Scammers use small early payments to build trust and silence doubt.

Affiliate scams work in a similar way but are disguised as partner programs. You’re told you can earn by helping a company complete orders, boost sales, or increase activity. The work feels like affiliate marketing, e-commerce support, or product promotion.

In reality, both models lead to the same point: you are required to deposit your own money to continue. That’s where real work ends and the scam begins.

Affiliate and task scams rarely operate chaotically — they follow a clear, well-rehearsed system. Understanding each stage helps potential victims recognize warning signs early.

You receive a message via Telegram, WhatsApp, Instagram, LinkedIn, or email. The message is personal, polite, and professional: “Are you looking for online work? No experience needed. Flexible hours. Fast payout.”

The scammers make it feel like an exclusive opportunity. It may seem like someone noticed your profile or work history.

Scammers can also lure victims through romantic or friendly conversations.

Tip for readers: Legitimate job offers rarely appear in DMs without an application process. Be cautious if the first contact asks for immediate action.

You complete a few simple tasks — liking posts, writing short reviews, installing apps, or clicking links. Then, a small payment arrives. Sometimes it’s real money, sometimes fake credits.

Early rewards build trust and create the feeling that the platform is legitimate. You start to believe, “If they paid me already, it must be real.”

Tip for readers: Genuine work platforms don’t pay instantly for trivial tasks, and any fast payout should be verified.

You are invited into a chat or a group with other “workers.” Tasks increase slightly in complexity, and you may be praised for good performance. Occasionally, you’re offered “special opportunities” for higher pay.

Social proof and recognition make people more invested. The sense of community reduces suspicion.

Tip for readers: Be wary of platforms that use constant praise or offer “VIP levels” — it’s a psychological hook.

The platform asks you to deposit money to unlock better-paying tasks or receive higher commissions. Common excuses look like “Activate your VIP account”, “Pay a small commission to release your earnings”, “Top-up to complete the next level of tasks”.

You’ve already seen small payouts and completed tasks. The requested deposit seems logical and low-risk.

Tip for readers: Any work that requires you to pay to earn is almost always a scam.

Once you deposit, the platform escalates: tasks become harder or new fees appear. You may be asked to pay more to fix errors, withdraw funds, or unlock bonuses. The user believes he has already invested, so he must continue, or he’ll lose everything. Account managers act like experts or legal enforcers.

Tip for readers: Legitimate platforms never charge you extra to access your own earnings.

When you try to withdraw, new conditions or rules suddenly appear. “Your account requires verification,” “You must complete one more task,” or “Bonus terms apply now.”

By the time rules change, the victim is financially and emotionally invested. The fear of losing prior gains keeps them engaged.

Tip for readers: Always check user reviews and legal status before depositing. Watch out for shifting rules.

The dashboard shows earnings increasing, commissions accumulating, and tasks pending. Everything appears measurable and real. People see “proof” of success in numbers, creating hope and preventing them from stopping.

Tip for readers: Screens can lie. Trust real cash flow, not platform dashboards.

Once deposits stop or victims refuse further payments, support disappears. Chat responses become slow or cease entirely. Victims are left with frozen balances and emotional frustration.

Tip for readers: Keep records of all communications, transactions, and screenshots — this is critical if you seek legal or chargeback assistance.

This type of fraud is built on psychology, not force.

Scammers are trained to sound calm, friendly, and helpful. They never rush you at first. They guide you.

Sooner or later, free tasks stop. You’re told you need to deposit money to:

The amounts increase slowly. $20 feels safe. $50 feels manageable. $200 feels necessary. Each time, your balance grows. It looks like profit. But it’s just numbers on a screen.

This is the core of the scam. The dashboard shows earnings growing in real time. You feel close to success. But the balance isn’t connected to any real financial system. It’s fully controlled by the scammers.

That’s why withdrawals never work.

There is always:

And when you stop paying, communication stops too.

Scammers use endless excuses:

These explanations are designed to sound technical and legitimate — but they are fake.

Affiliate and task scams repeat the same warning signs:

If any “job” asks you to invest your own money — it is not a job.

Affiliate and task scams don’t steal money in one move. They do it step by step, while making the victim feel in control. That’s why they spread so fast — and why so many people don’t see the danger until it’s too late.

If a platform pays you first, then asks you to pay to continue, that’s not work. That’s the scam.