Companies in this section

Article Content

| Website Address | https://tradgrip.com |

| support@tradgrip.com | |

| Founded Date | Operating since 2025 |

| Head Office | Bonovo Road, Fomboni, Comoros, KM |

| Support Phone | +441863440820; +441970450369; +815031041589 |

TradGrip positions itself as a multifunctional platform for CFD trading, offering access to various assets, user-friendly interfaces, and multi-device compatibility. Formally, the brand belongs to Zenith Markets PLC, registered in the Comoros Islands and licensed by the local regulator MISA — a structure with a low level of control and no international recognition (license BFX2024031 dated March 10, 2025).

The company emphasizes the convenience of trading, the availability of educational materials, technical tools, and flexible account types. However, the jurisdiction of registration and the nature of licensing indicate offshore regulation, which does not provide trader protection at the level of the EU, the UK, or Australia. This reduces the level of reliability, especially in matters of withdrawal of funds and resolution of financial disputes.

The launch date of the project is not disclosed. It is stated that the service is based on transparency and compliance with regulations. TradeGrip positions itself as a platform created within the framework of established rules and procedures.

Users of the platform can access educational materials, from reference sections to market news.

To contact support, an email address, feedback form, and phone numbers are provided:

+441863440820;

+441970450369;

+815031041589.

The stated office is registered to Zenith Markets PLC at Bonovo Road, Fomboni, Comoros, KM.

Account Registration on tradgrip.com

To open an account and gain access to all the platform's features, simply register. All you need to do is enter your first and last name, phone number, create a password, and agree to the broker's internal documents. The company requires mandatory verification.

Available Markets and Trading Platform of Trad Grip

One of the key advantages of Trad Grip is the ability to work with different asset classes from a single device. The unified platform offers:

currency pairs,

commodities,

shares of major companies,

stock indices,

and cryptocurrencies.

This set of tools allows you to flexibly distribute your attention between different market sectors. In addition, the company points out the availability of an application for smartphones.

Trading Accounts of the Broker TradGrip

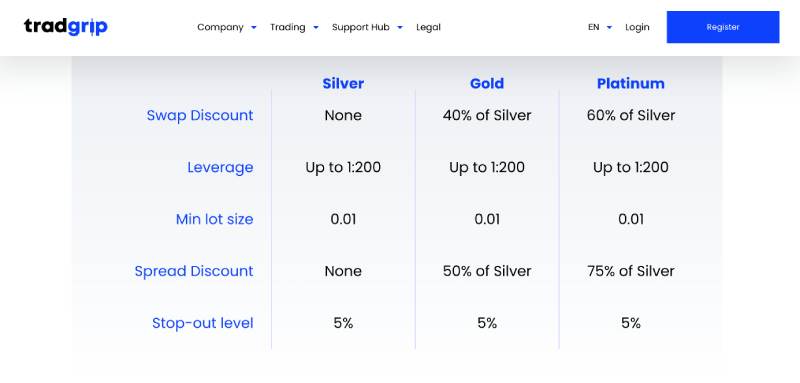

The TradeGrip platform offers three types of accounts. Each of them differs in terms of exchange discounts, trading conditions, and additional benefits for traders.

Silver: Basic option without exchange and spread discounts. Leverage of up to 1:200 is available, with a minimum trade volume of 0.01 lots. Stop-out is triggered at 5%.

Gold: An account with improved conditions: a 40% discount from the Silver level is applied, and the spread is reduced by 50%. Leverage is also up to 1:200, with a minimum lot size of 0.01. The stop-out level is 5%.

Platinum: Maximum privileged rate. The exchange discount reaches 60% of the Silver level, and the spread is reduced by 75%. Leverage remains up to 1:200, minimum position size is 0.01 lot. Stop-out is 5%.

Depositing Funds and Withdrawing Money from TradGrip

Funds can be deposited into TredGrip via

bank cards, transfers, and

digital payment solutions.

Funds are credited to the account after the payment is processed, allowing you to start trading quickly.

Withdrawals on TradeGrip are processed through your personal account. Requests are processed in the established order, after which the funds are sent to the client using the selected method. There are no stated terms or limits.

Brief Conclusion about TradGrip

A typical offshore broker with attractive terms on paper, but with low guarantees for the user. An offshore license, lack of transparent reporting, and minimal information about the actual structure of the company require caution. For safe trading, you should first study the document and TradGrip reviews on independent resources.

Frequently Asked Questions

The overwhelming majority of brokers are scammers. Traders can identify illegitimate ones by using free online resources. It is essential to verify the company's registration, the licensing of its services, and its operational history. It is also important to assess the completeness and authenticity of contact information and the transparency of trading conditions.

You can consult specialists who can help evaluate the broker and identify signs of fraud, and if necessary, assist in opening an account with a reliable service provider. A knowledgeable and comprehensive approach will help avoid negative trading experiences.

First and foremost, pay attention to the content of the comments. Excessively emotional opinions without specifics may indicate paid content. Additionally, a broker's positive reputation may be indicated by mass activity on a single online portal or forum. Another sign of fake reviews is their formulaic nature. Such comments are filled with general phrases and advertising slogans. Fraudulent projects use paid content to confuse traders and lure them into cooperation.

It is important not to fall for the tricks of company representatives. This can lead to additional financial losses. With legitimate brokers, withdrawing funds is a free service that is not subject to any fees such as insurance, taxes, commissions, etc.

If you need assistance in withdrawing capital, it is advisable to consult specialists. Timely consultation with experts can help achieve positive results and withdraw funds from the brokerage account.

In the case of scam brokers, account blocking may be related to a simple refusal to withdraw funds. Clients are accused of violating agreements, money laundering, technical work on the platform, etc. Such manipulations are aimed at depriving traders of the ability to withdraw capital.

When a brokerage account or personal account is blocked, it is better to use the services of professionals . Depending on the reason for the blockage, experts can find the optimal solution to the problem.

The reasons for the inactivity of a brokerage company's presentation portal can vary widely. Blocking due to numerous complaints, cessation of project activities, inclusion in the blacklist of trading platforms — all of this can lead to access issues to the broker's site. Additionally, unstable internet connection and browser restrictions can cause improper functioning of the resource.

If the official broker's website does not open, seek help from experts. They will advise on any questions and provide recommendations for further actions.

First and foremost, it is important to ensure that there are no assets in the account and no debts to the broker. If there are instruments in the investment portfolio, they should be sold, and you should wait for the settlements to be completed. After that, you can submit a request for the withdrawal of funds and the closure of the brokerage account.

If the broker refuses to fulfill requests, it is better to consult experts. They can assist in closing the brokerage account and recovering funds through chargebacks . When preparing to dispute transactions, it is necessary to gather all available evidence of cooperation with the project. This will help increase the chances of successfully initiating refunds.