Companies in this section

Article Content

| Website Address | https://smart-stp.com |

| support@smart-stp.com | |

| Founded Date | Operating since 2026 |

| Head Office | 7th Floor, Tower 1, NeXTeracom, Cybercity, Ebene, Mauritius |

| Support Phone | Not mentioned |

The online broker Smart STP presents itself as a multi-asset CFD intermediary positioned as a contemporary trading environment with access to international financial markets and a range of advanced trading solutions. According to the company, its platform supports trading in more than 280 instruments, including CFDs on currency pairs, precious metals, and commodities.

The website smartstp.com is operated by MRL Investments Ltd, a Mauritius-registered entity (registration number 187076GBC) authorized by the FSC under license No. GB21027168. The company’s registered office is located at 7th Floor, Tower 1, NeXTeracom, Cybercity, Ebene, Mauritius.

You can contact the broker SmartSTP via online chat or email.

Account Registration on smartstp.com

Clients can register via smartstp.com or smart-stp.com by providing personal information:

full name;

email;

phone number;

secure password.

Following account creation, users are required to complete identity verification to access the full range of trading features. All account management and document submissions are performed through the personal account Smart STP.

Available Markets and Trading Platform of Smart STP

Broker SmartSTP offers a wide selection of CFD instruments:

currencies;

metals;

commodities;

and other financial markets.

The platform claims innovation not only in its architecture but also in analytics, alerts, and educational content. Trading is supported through both a desktop platform and a mobile application.

Trading Accounts of the Broker SmartSTP

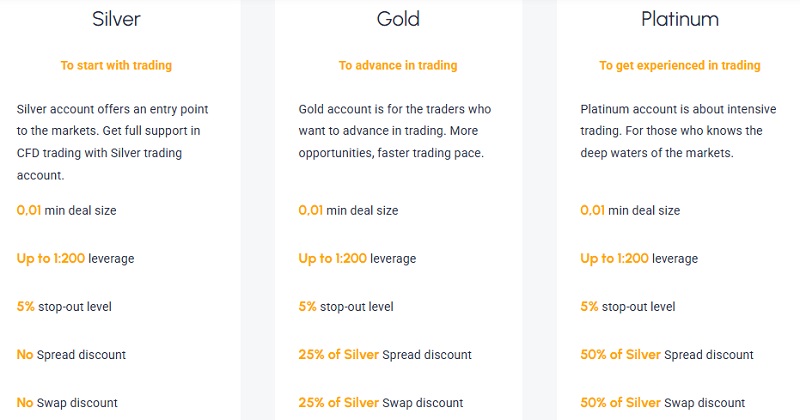

Broker Smart STP offers several account categories designed to accommodate varying trading strategies and experience levels.

Silver Account is positioned as a basic entry-level option, allowing trades from 0.01 lots with leverage up to 1:200. The stop-out level is set at 5%, while trading conditions do not include any reductions on spreads or swap fees.

Gold Account maintains the same maximum leverage of 1:200 and a 5% stop-out threshold, but offers improved cost efficiency through a 25% reduction in both spreads and swaps compared to the Silver tier.

Platinum Account is aimed at more active traders, featuring a minimum lot size of 0.01, leverage up to 1:200, and a 5% stop-out level. Broker SmartSTP provides significantly lower trading costs, with spreads and swaps reduced by 50% relative to the Silver account.

Islamic Account is available as a swap-free alternative, tailored for traders who require compliance with specific religious principles.

Broker SmartSTP does not disclose any information regarding the minimum deposit requirement.

Depositing Funds and Withdrawing Money from Smart STP

The platform supports various methods of depositing and withdrawing funds from Smart STP, including:

bank cards;

wire transfers;

electronic payment systems.

Details regarding processing times, fees, and limits are not publicly disclosed. Users can manage transactions and monitor funds directly via the personal account SmartSTP, while withdrawal should be verified through client support or account dashboard.

Brief Conclusion about Smart STP

Broker SmartSTP operates under an offshore license issued to MRL Investments (MU) Ltd in Mauritius (FSC license number GB21027168). The company does not explicitly operate in Europe, and detailed trading conditions, such as minimum deposit thresholds and contract specifications, are not publicly available. Traders are advised to consult SmartSTP reviews to assess actual user experiences regarding trading execution and fund withdrawals.

Frequently Asked Questions

The overwhelming majority of brokers are scammers. Traders can identify illegitimate ones by using free online resources. It is essential to verify the company's registration, the licensing of its services, and its operational history. It is also important to assess the completeness and authenticity of contact information and the transparency of trading conditions.

You can consult specialists who can help evaluate the broker and identify signs of fraud, and if necessary, assist in opening an account with a reliable service provider. A knowledgeable and comprehensive approach will help avoid negative trading experiences.

First and foremost, pay attention to the content of the comments. Excessively emotional opinions without specifics may indicate paid content. Additionally, a broker's positive reputation may be indicated by mass activity on a single online portal or forum. Another sign of fake reviews is their formulaic nature. Such comments are filled with general phrases and advertising slogans. Fraudulent projects use paid content to confuse traders and lure them into cooperation.

It is important not to fall for the tricks of company representatives. This can lead to additional financial losses. With legitimate brokers, withdrawing funds is a free service that is not subject to any fees such as insurance, taxes, commissions, etc.

If you need assistance in withdrawing capital, it is advisable to consult specialists. Timely consultation with experts can help achieve positive results and withdraw funds from the brokerage account.

In the case of scam brokers, account blocking may be related to a simple refusal to withdraw funds. Clients are accused of violating agreements, money laundering, technical work on the platform, etc. Such manipulations are aimed at depriving traders of the ability to withdraw capital.

When a brokerage account or personal account is blocked, it is better to use the services of professionals . Depending on the reason for the blockage, experts can find the optimal solution to the problem.

The reasons for the inactivity of a brokerage company's presentation portal can vary widely. Blocking due to numerous complaints, cessation of project activities, inclusion in the blacklist of trading platforms — all of this can lead to access issues to the broker's site. Additionally, unstable internet connection and browser restrictions can cause improper functioning of the resource.

If the official broker's website does not open, seek help from experts. They will advise on any questions and provide recommendations for further actions.

First and foremost, it is important to ensure that there are no assets in the account and no debts to the broker. If there are instruments in the investment portfolio, they should be sold, and you should wait for the settlements to be completed. After that, you can submit a request for the withdrawal of funds and the closure of the brokerage account.

If the broker refuses to fulfill requests, it is better to consult experts. They can assist in closing the brokerage account and recovering funds through chargebacks . When preparing to dispute transactions, it is necessary to gather all available evidence of cooperation with the project. This will help increase the chances of successfully initiating refunds.