Companies in this section

Latest Articles

- Problems With Withdrawing Funds From a Broker: Causes and Solutions

- Chargeback, Crypto Tracing, Courts, or Negotiations: Which Recovery Method Is Right for You?

- Trust Wallet Scams: How Users Lose Funds and How to Protect Yourself

- How to Protect Yourself From P2P Crypto Scams on Bybit

- How to Avoid Phishing and Fake Crypto Websites

Article Content

| Website Address | https://quomarkets.com |

| support@quomarkets.com | |

| Founded Date | Operating since 2025 |

| Head Office | 8 Jepson Lane, St. George's, Goodwill, Commonwealth of Dominica |

| Support Phone | not mentioned |

International broker QuoMarkets provides its clients with the opportunity to trade and invest in global financial markets, providing access to the most liquid assets.

The company does not disclose the launch date of the project, but the website displays a TRADEQUOMARKETS LTD license, and the company can legally offer currency and CFD trading, but only in the jurisdiction of Dominica. Such a license is not equivalent to regulation by serious regulators such as the FCA (UK) or CySEC (Cyprus), but formally gives the company the right to legally operate as a CFD/Forex dealer under local supervision.

Quo Markets offers modern technological solutions, fast order execution, and a comfortable trading environment. The company claims to focus on creating equal opportunities for investors with any income level — you can start with as little as $1.

In addition, QuoMarkets.com is developing an educational ecosystem and provides users with ongoing support at all stages of their investment journey, helping them to confidently navigate the market and achieve their financial goals.

The broker has two domains:

quomarkets.com,

my.quomarkets.com.

TRADEQUOMARKETS LTD (2023/C0024), operating under license No. 2023/C0010-0001. Address: 8 Jepson Lane, St. George's, Goodwill, Commonwealth of Dominica.

Account Registration on quomarkets.com

To register on the platform, you need to go to the appropriate tab and fill out a fairly detailed new member form. Agree to the company's internal policies and documents, and complete the account creation process. It is likely that after registering on the platform, you will need to complete verification.

Available Markets and Trading Platform of QuoMarkets

The international platform of TRADE QUO GLOBAL LTD offers its users a convenient and technologically advanced environment for trading and investing — all in one place. The intuitive application allows you to start working with stock and cryptocurrency markets in just a few clicks.

It is stated that clients can create and manage investment portfolios, including

stocks,

cryptocurrencies,

currency pairs,

indices,

commodities.

The modern and adaptive interface makes the investment process simple and intuitive, providing quick access to more than 350 markets.

The platform supports MetaTrader 5 (MT5), a modern multi-market system with advanced technical and fundamental analysis capabilities, as well as automated trading via robots and trading signals. MT5 is available on any device—PC, Mac, smartphone, or tablet—allowing you to trade from anywhere in the world.

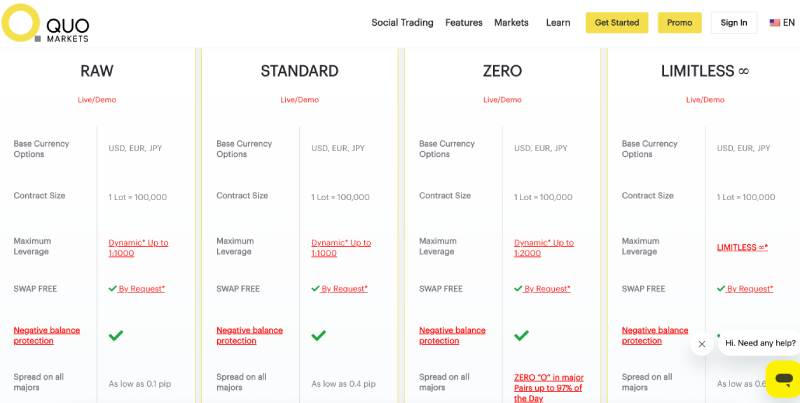

Trading Accounts of the Broker Quo Markets

On the website, brokers can choose one of the following account types:

RAW: minimum deposit of $1, dynamic leverage up to 1:1000, spreads from 0.1 pips,

STANDARD: minimum deposit of $1, leverage up to 1:1000, spreads from 0.4 pips,

ZERO: minimum deposit of $1, leverage up to 1:2000, spreads from 0 pips,

LIMITLESS: minimum deposit of $1, unlimited leverage, spreads from 0.6 pips.

The broker offers margin trading and CFD trading on its modern platform with access to all assets available on the platform.

In addition, the company also offers not only competent investment and asset allocation, but also copy trading, where users in the community can not only exchange opinions, but also learn from the experience and strategies of experienced traders.

It is likely that the site has a single cash account, but the trading conditions can only be found out after registration.

Depositing Funds and Withdrawing Money from QuoMarkets

The company offers payment methods such as electronic payment systems, bank transfers, cryptocurrencies, and plastic cards.

The minimum deposit can vary from $1 to $25 depending on the system. No commissions.

The withdrawal limit is $10, and the processing time ranges from a few minutes to several days.

There are no withdrawal fees.

Brief Conclusion about QuoMarkets

Despite the trading and investment conditions offered with competent portfolio diversification, the company still does not provide documentary evidence of its registration, and the license issued by the Dominican Republic regulator has only limited territorial validity. Therefore, before working with this broker, it is important to study customer reviews of QuoMarkets on independent resources.

Frequently Asked Questions

The overwhelming majority of brokers are scammers. Traders can identify illegitimate ones by using free online resources. It is essential to verify the company's registration, the licensing of its services, and its operational history. It is also important to assess the completeness and authenticity of contact information and the transparency of trading conditions.

You can consult specialists who can help evaluate the broker and identify signs of fraud, and if necessary, assist in opening an account with a reliable service provider. A knowledgeable and comprehensive approach will help avoid negative trading experiences.

First and foremost, pay attention to the content of the comments. Excessively emotional opinions without specifics may indicate paid content. Additionally, a broker's positive reputation may be indicated by mass activity on a single online portal or forum. Another sign of fake reviews is their formulaic nature. Such comments are filled with general phrases and advertising slogans. Fraudulent projects use paid content to confuse traders and lure them into cooperation.

It is important not to fall for the tricks of company representatives. This can lead to additional financial losses. With legitimate brokers, withdrawing funds is a free service that is not subject to any fees such as insurance, taxes, commissions, etc.

If you need assistance in withdrawing capital, it is advisable to consult specialists. Timely consultation with experts can help achieve positive results and withdraw funds from the brokerage account.

In the case of scam brokers, account blocking may be related to a simple refusal to withdraw funds. Clients are accused of violating agreements, money laundering, technical work on the platform, etc. Such manipulations are aimed at depriving traders of the ability to withdraw capital.

When a brokerage account or personal account is blocked, it is better to use the services of professionals . Depending on the reason for the blockage, experts can find the optimal solution to the problem.

The reasons for the inactivity of a brokerage company's presentation portal can vary widely. Blocking due to numerous complaints, cessation of project activities, inclusion in the blacklist of trading platforms — all of this can lead to access issues to the broker's site. Additionally, unstable internet connection and browser restrictions can cause improper functioning of the resource.

If the official broker's website does not open, seek help from experts. They will advise on any questions and provide recommendations for further actions.

First and foremost, it is important to ensure that there are no assets in the account and no debts to the broker. If there are instruments in the investment portfolio, they should be sold, and you should wait for the settlements to be completed. After that, you can submit a request for the withdrawal of funds and the closure of the brokerage account.

If the broker refuses to fulfill requests, it is better to consult experts. They can assist in closing the brokerage account and recovering funds through chargebacks . When preparing to dispute transactions, it is necessary to gather all available evidence of cooperation with the project. This will help increase the chances of successfully initiating refunds.

Reviews aboutQuo Markets 2

Share your opinion

Companies in this section

Latest Articles

- Problems With Withdrawing Funds From a Broker: Causes and Solutions

- Chargeback, Crypto Tracing, Courts, or Negotiations: Which Recovery Method Is Right for You?

- Trust Wallet Scams: How Users Lose Funds and How to Protect Yourself

- How to Protect Yourself From P2P Crypto Scams on Bybit

- How to Avoid Phishing and Fake Crypto Websites