Companies in this section

Latest Articles

- Problems With Withdrawing Funds From a Broker: Causes and Solutions

- Chargeback, Crypto Tracing, Courts, or Negotiations: Which Recovery Method Is Right for You?

- Trust Wallet Scams: How Users Lose Funds and How to Protect Yourself

- How to Protect Yourself From P2P Crypto Scams on Bybit

- How to Avoid Phishing and Fake Crypto Websites

Article Content

| Website Address | https://invesacapital.info |

| info@invesacapital.info | |

| Founded Date | Operating since 2024 |

| Head Office | 2nd Floor, Rivonia Village, Cnr Mutual Road & Rivonia Boulevard, Rivonia, 2191, Johannesburg, South Africa |

| Support Phone | +27101571933 |

InvesaCapital calls itself a brokerage platform managed by Imermarket (PTY) LTD, formerly Xenium Financial Managers (PTY) Limited. It is also stated that the broker is regulated by the FSCA (the financial regulator of South Africa).

The following web addresses are used for online operations:

invesacapital.info;

webtrader.invesacapital.info.

The footer of the Invesa Capital website mentions the company's representative office located at 2nd Floor, Rivonia Village, Cnr Mutual Road & Rivonia Boulevard, Rivonia, 2191, Johannesburg, South Africa. To communicate with technical support staff, they publish the phone number +27101571933 and the email address info@invesacapital.info. An online chat is also available for communication.

Account Registration on invesacapital.info

When creating an account on the InvesaCapital platform, you must provide:

Account type (real or demo);

Full name;

Contact details.

Registration also requires agreeing to the platform's rules and confirming that the client is 18 years of age or older.

Available Markets and Trading Platform of InvesaCapital

The Invesa Capital brokerage company promises clients trade execution on the following financial markets:

Forex market;

Digital tokens market;

Indices market;

Metals market;

Commodities market.

They promise instant trade confirmation in real-time. They mention the platform's adaptation, including for mobile devices. They promise round-the-clock support in various languages (including Russian and English). There is also a set of educational materials available on the website to every user. A demonstration account can also be opened to test the available web terminal without financial risks.

Trading Accounts of the Broker Invesa Capital

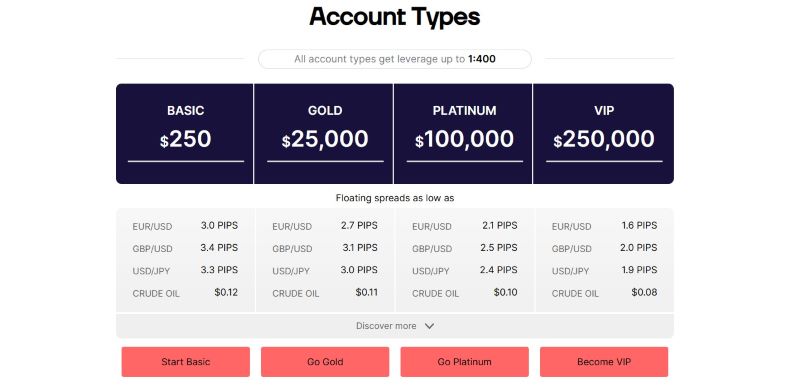

For real trading, the financial intermediary InvesaCapital offers traders the following types of trading accounts:

Basic Trading Account. Requires investments starting from $250.

"Gold" Trading Account. Requires a deposit starting from $25,000.

"Platinum" Trading Account. Requires investments starting from $100,000.

VIP Trading Account. Requires investments starting from $250,000.

Depositing Funds and Withdrawing Money from InvesaCapital

The official Invesa Capital website states that clients can use both bank cards and cryptocurrency wallets to fund their balance and withdraw earnings. Some electronic payment services are also supported. Bank transfers can also be made. Financial settlements on the platform are conducted in US dollars or Euros. For clarifications on commissions, limits, and other financial matters, clients must contact the broker's technical support.

Brief Conclusion about InvesaCapital

The InvesaCapital brokerage organization does not provide clear information about its management and shows minimal documentation. The trading conditions on the platform are described without the necessary specificity, requiring clients to contact company staff for clarification on many important issues. The fact that client reviews about InvesaCapital online are not particularly complimentary is also concerning. Therefore, a potential trader must absolutely consider the negative experiences of other clients to avoid risking their capital in vain.

Frequently Asked Questions

The overwhelming majority of brokers are scammers. Traders can identify illegitimate ones by using free online resources. It is essential to verify the company's registration, the licensing of its services, and its operational history. It is also important to assess the completeness and authenticity of contact information and the transparency of trading conditions.

You can consult specialists who can help evaluate the broker and identify signs of fraud, and if necessary, assist in opening an account with a reliable service provider. A knowledgeable and comprehensive approach will help avoid negative trading experiences.

First and foremost, pay attention to the content of the comments. Excessively emotional opinions without specifics may indicate paid content. Additionally, a broker's positive reputation may be indicated by mass activity on a single online portal or forum. Another sign of fake reviews is their formulaic nature. Such comments are filled with general phrases and advertising slogans. Fraudulent projects use paid content to confuse traders and lure them into cooperation.

It is important not to fall for the tricks of company representatives. This can lead to additional financial losses. With legitimate brokers, withdrawing funds is a free service that is not subject to any fees such as insurance, taxes, commissions, etc.

If you need assistance in withdrawing capital, it is advisable to consult specialists. Timely consultation with experts can help achieve positive results and withdraw funds from the brokerage account.

In the case of scam brokers, account blocking may be related to a simple refusal to withdraw funds. Clients are accused of violating agreements, money laundering, technical work on the platform, etc. Such manipulations are aimed at depriving traders of the ability to withdraw capital.

When a brokerage account or personal account is blocked, it is better to use the services of professionals . Depending on the reason for the blockage, experts can find the optimal solution to the problem.

The reasons for the inactivity of a brokerage company's presentation portal can vary widely. Blocking due to numerous complaints, cessation of project activities, inclusion in the blacklist of trading platforms — all of this can lead to access issues to the broker's site. Additionally, unstable internet connection and browser restrictions can cause improper functioning of the resource.

If the official broker's website does not open, seek help from experts. They will advise on any questions and provide recommendations for further actions.

First and foremost, it is important to ensure that there are no assets in the account and no debts to the broker. If there are instruments in the investment portfolio, they should be sold, and you should wait for the settlements to be completed. After that, you can submit a request for the withdrawal of funds and the closure of the brokerage account.

If the broker refuses to fulfill requests, it is better to consult experts. They can assist in closing the brokerage account and recovering funds through chargebacks . When preparing to dispute transactions, it is necessary to gather all available evidence of cooperation with the project. This will help increase the chances of successfully initiating refunds.

Reviews aboutInvesaCapital 3

Share your opinion

Companies in this section

Latest Articles

- Problems With Withdrawing Funds From a Broker: Causes and Solutions

- Chargeback, Crypto Tracing, Courts, or Negotiations: Which Recovery Method Is Right for You?

- Trust Wallet Scams: How Users Lose Funds and How to Protect Yourself

- How to Protect Yourself From P2P Crypto Scams on Bybit

- How to Avoid Phishing and Fake Crypto Websites