Companies in this section

Latest Articles

- Problems With Withdrawing Funds From a Broker: Causes and Solutions

- Chargeback, Crypto Tracing, Courts, or Negotiations: Which Recovery Method Is Right for You?

- Trust Wallet Scams: How Users Lose Funds and How to Protect Yourself

- How to Protect Yourself From P2P Crypto Scams on Bybit

- How to Avoid Phishing and Fake Crypto Websites

Article Content

| Website Address | https://colmexpro.com |

| support@colmexpro.com | |

| Founded Date | Operating since 2010 |

| Head Office | 117 Makariou III Avenue & Sissifou Street, Apostoloi Petrou & Pavlou Quarter, 3021 Limassol, Cyprus |

| Support Phone | +(357) 25-030036 |

Colmex Pro is a Cypriot investment company that has been operating on the market since 2010, providing high-quality trading services on the global market.

It is licensed by CySEC (Cyprus) and ASIC (Australia). According to the organizers, the client base exceeds 8,000 registered users.

According to the website, the broker's team consists of professionals who support clients and assist them in working with the platform. ColmexPro emphasizes the use of modern technologies, including its own interface, advanced charts, analytical tools, and the ability to trade directly from the chart.

The broker highlights the fast response of its support service — 24/5 — and the fact that part of the functionality was developed at the request of clients. Separately, it emphasizes the storage of client funds in segregated accounts and deposit coverage through the Investor Compensation Fund for amounts up to €20,000.

According to the broker's website, the company strives to expand the list of available markets and instruments, update its range of platforms, and improve conditions for both novice and professional traders.

The broker claims to manage several domains:

colmexpro.com

my.colmexpro.com

To contact support, the phone number is +(357) 25-030036, the email address is available, there is a feedback form, and the office address is stated as: 117 Makariou III Avenue & Sissifou Street, Apostolos Petros & Pavlos Quarter, 3021 Limassol, Cyprus.

Account Registration on colmexpro.com

To join trading on the platform, you need to fill out a form on the website, providing your personal and contact details. After passing verification, you will need to complete an identity check.

Available Markets and Trading Platform of Colmex Pro

ColmexPro offers its clients access to the following instruments, claiming to have more than 28,000 of them:

shares of leading companies,

currency pairs,

indices,

commodities,

ETFs, and CFDs.

Clients can work through their own Colmex Pro 2.0 terminal, as well as use Web Trader, the desktop version, and the mobile app. Additionally, TradingView and MetaTrader 4 (for PC and smartphone) are available.

Trading Accounts of the Broker ColmexPro

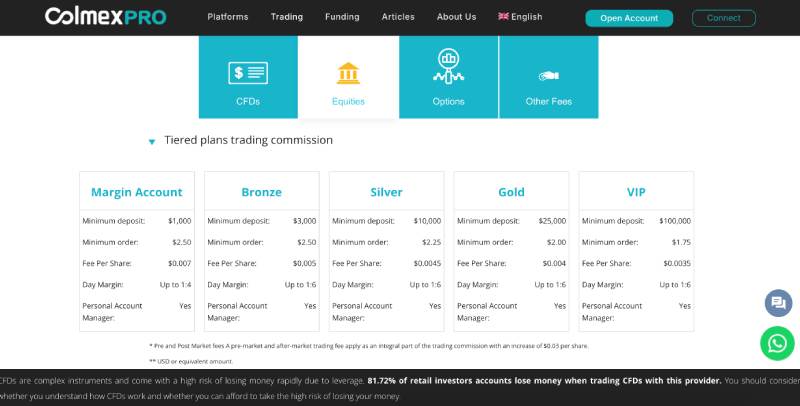

The broker offers several levels of trading accounts:

Margin Account — from $1,000, leverage up to 1:4 available.

Bronze — from $3,000, leverage up to 1:6.

Silver — from $10,000, leverage up to 1:6.

Gold — from $25,000, leverage up to 1:6.

VIP — from $100,000, with leverage up to 1:6.

Regarding conditions, Colmex Pro specifies a minimum deposit of $1,000 and above, depending on the package selected. The commission per share varies, and the minimum order requirements decrease as the account level increases. Margin trading is available with leverage up to 1:6.

However, detailed conditions, such as the full commission structure, additional fees, or instrument restrictions, can only be found out by studying the contract specifications and opening an account.

In addition, the company offers trading through a demo account with virtual funds, IPO investing, expert assistance, and more.

Depositing Funds and Withdrawing Money from Colmex Pro

Transactions on the platform are carried out via

EPS,

bank accounts, and payment cards.

Withdrawal limits are $50, but the terms and fees are not specified on the website.

Brief Conclusion about Colmex Pro

The financial company is a licensed Cypriot broker with terms and conditions that may not suit everyone. Beginner traders may find the high entry thresholds and strict internal rules inconvenient. Those considering cooperation should carefully study the regulations, tariffs, and withdrawal features, as well as rely on their own experience and independent reviews of Colmex Pro on independent resources.

Frequently Asked Questions

The overwhelming majority of brokers are scammers. Traders can identify illegitimate ones by using free online resources. It is essential to verify the company's registration, the licensing of its services, and its operational history. It is also important to assess the completeness and authenticity of contact information and the transparency of trading conditions.

You can consult specialists who can help evaluate the broker and identify signs of fraud, and if necessary, assist in opening an account with a reliable service provider. A knowledgeable and comprehensive approach will help avoid negative trading experiences.

First and foremost, pay attention to the content of the comments. Excessively emotional opinions without specifics may indicate paid content. Additionally, a broker's positive reputation may be indicated by mass activity on a single online portal or forum. Another sign of fake reviews is their formulaic nature. Such comments are filled with general phrases and advertising slogans. Fraudulent projects use paid content to confuse traders and lure them into cooperation.

It is important not to fall for the tricks of company representatives. This can lead to additional financial losses. With legitimate brokers, withdrawing funds is a free service that is not subject to any fees such as insurance, taxes, commissions, etc.

If you need assistance in withdrawing capital, it is advisable to consult specialists. Timely consultation with experts can help achieve positive results and withdraw funds from the brokerage account.

In the case of scam brokers, account blocking may be related to a simple refusal to withdraw funds. Clients are accused of violating agreements, money laundering, technical work on the platform, etc. Such manipulations are aimed at depriving traders of the ability to withdraw capital.

When a brokerage account or personal account is blocked, it is better to use the services of professionals . Depending on the reason for the blockage, experts can find the optimal solution to the problem.

The reasons for the inactivity of a brokerage company's presentation portal can vary widely. Blocking due to numerous complaints, cessation of project activities, inclusion in the blacklist of trading platforms — all of this can lead to access issues to the broker's site. Additionally, unstable internet connection and browser restrictions can cause improper functioning of the resource.

If the official broker's website does not open, seek help from experts. They will advise on any questions and provide recommendations for further actions.

First and foremost, it is important to ensure that there are no assets in the account and no debts to the broker. If there are instruments in the investment portfolio, they should be sold, and you should wait for the settlements to be completed. After that, you can submit a request for the withdrawal of funds and the closure of the brokerage account.

If the broker refuses to fulfill requests, it is better to consult experts. They can assist in closing the brokerage account and recovering funds through chargebacks . When preparing to dispute transactions, it is necessary to gather all available evidence of cooperation with the project. This will help increase the chances of successfully initiating refunds.

Reviews aboutColmex Pro 2

Share your opinion

Companies in this section

Latest Articles

- Problems With Withdrawing Funds From a Broker: Causes and Solutions

- Chargeback, Crypto Tracing, Courts, or Negotiations: Which Recovery Method Is Right for You?

- Trust Wallet Scams: How Users Lose Funds and How to Protect Yourself

- How to Protect Yourself From P2P Crypto Scams on Bybit

- How to Avoid Phishing and Fake Crypto Websites