- Home /

- Cryptocurrency Wallets /

-

Brave Wallet

Companies in this section

Article Content

| Website Address | https://brave.com/wallet |

| user-support@brave.com | |

| Founded Date | Operating since 2021 |

| Head Office | 580 Howard Street, Unit #402, San Francisco, USA |

| Support Phone | Not mentioned |

A modern cryptocurrency Brave Wallet is positioned as a native feature of the Brave browser, allowing users to work with blockchain assets without installing third-party extensions. The solution was officially launched in 2021 as part of the Brave ecosystem and is aimed at simplifying access to Web3 technologies.

The wallet is developed by Brave Software, Inc., headquartered at 580 Howard Street, Unit #402, San Francisco, CA 94105. According to its description, the service follows a self-custody model. At the same time, Brave Wallet operates without direct oversight from a financial regulator, which may be relevant for users comparing it with licensed crypto services.

Support communication is limited to email, and no public phone number is listed, which narrows the available channels for resolving operational issues.

Supported Cryptocurrencies on Brave Wallet

The Brave Wallet supports assets across multiple blockchain networks. It is compatible with:

Ethereum and ERC-20 tokens;

Solana and SPL tokens;

EVM-based networks such as Polygon, BNB Chain, Avalanche, Celo, and Optimism.

The service also allows users to store and manage NFTs. In addition, asset availability can be expanded through integrated on-ramp partners, depending on geographic restrictions and third-party conditions.

The Brave Wallet focuses on independent asset control and interaction with decentralized environments. Private keys are generated locally, reinforcing the non-custodial nature of the platform.

Key Functions of Brave Wallet

Key features include:

support for multi-chain assets and NFTs;

direct access to decentralized applications (DApps);

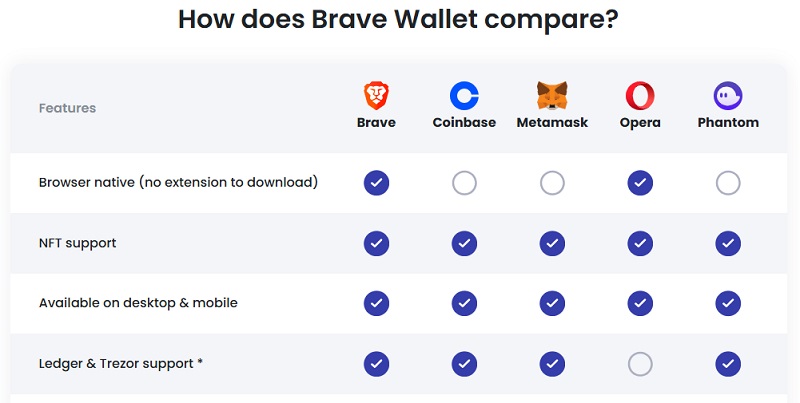

integration with hardware wallets like Ledger and Trezor;

a built-in token swap aggregator;

cryptocurrency purchases via external providers.

The personal account Brave Wallet is accessible directly through the browser interface, eliminating the need for additional software.

Account Registration and Login on brave.com/wallet

The Brave Wallet does not require traditional registration. Once enabled in the browser, the system creates a seed phrase and cryptographic keys on the user’s device.

Access to the personal account Brave Wallet depends entirely on this data. If the recovery phrase is lost, centralized restoration options are not available.

Depositing and Withdrawing Funds from Brave Wallet

Users can fund the wallet by transferring crypto assets from external platforms. Purchasing digital currencies through integrated on-ramps is also possible where supported.

The withdrawal of funds from Brave Wallet is carried out by sending assets to other blockchain addresses. Network fees are paid in the form of gas charges set by the respective blockchains, not by the wallet provider.

Brief Conclusion about Brave Wallet

Although the wallet is developed by an established technology company, it does not disclose licensing associated with regulated financial services. For this reason, reviewing independent reviews of Brave Wallet may help users better assess whether this digital service aligns with their expectations and risk tolerance.

Frequently Asked Questions

To determine if a wallet is a legitimate service, it is important to study its reputation among real users and experts. Special attention should be paid to the legality of its operations — the presence of registration and a license from the relevant authorities. The quality of the presentation portal and customer support is also an important factor in the verification process. Additionally, one should pay attention to URLs, as scammers can create phishing websites with domains that resemble official ones.

To make the right decision when choosing a crypto wallet, it is better to trust the verification to specialists . They will monitor the basic aspects of the service and provide a corresponding verdict.

Fake comments are characterized by a lack of specifics. Typically, they contain only general phrases without describing real user experiences. Additionally, artificially inflated reviews often show unnatural enthusiasm, indicating attempts at manipulation and psychological influence. The mass appearance of fake reviews within the same period is another sign of their inauthenticity.

Real comments provide a balanced assessment of the service. They include both the advantages and disadvantages of the wallet. A good indicator is if the reviews are published on different, independent platforms.

This is a classic sign of fraud. Legitimate platforms can only charge clients transaction fees, which are deducted from the withdrawal amount or paid at the time of the transaction. Any attempts to convince a client of the necessity of making additional payments to withdraw their own assets are pure manipulation.

If faced with such a situation, one should cease interaction with the platform and not make any transfers. To resolve the withdrawal issue, it is better to consult competent specialists. They will help clarify the circumstances and withdraw the assets.

You should contact the service support to find out the reason for the block. If the issues are related to a lack of verification, you need to provide the necessary information to personalize your profile. You can try to regain access by backing up data or using a seed phrase.

If the listed actions do not help resolve the issue, the block of the personal account may be related to fraud. This is how scammers terminate cooperation with clients and deprive them of the ability to withdraw their own assets. Seeking professional support will be the optimal solution. Experts will help identify the reason for the block and suggest measures for further actions.

This may be related to issues with user software and the digital platform. In the first case, the reasons for disruptions could be weak internet or its absence, VPN connection, or an outdated browser version. In the second case, incorrect software operation may result from server malfunctions, scheduled maintenance work, or service blocking due to numerous complaints.

Fraudulent services use website and app blocking to steal client assets. This way, they cut off contact with the user and appropriate their funds. In such situations, it is better to consult specialists . They will provide comprehensive answers to any questions.

In this case, it is advisable to use the services of experts who specialize in chargeback procedures. It is important for the client to prepare all available evidence of cooperation with the digital platform — screenshots of correspondence, receipts or statements of transfers, wallet addresses, etc.

When faced with the issue of recovering funds, it is crucial to act promptly. The chargeback procedure has its timelines and can only be conducted once. To ensure an effective recovery, it is essential to contact specialists immediately. This will allow for thorough preparation for initiating return payments in accordance with established regulations and requirements.