Companies in this section

Article Content

| Website Address | https://cginvest.com |

| support@cginvest.com | |

| Founded Date | Operating since 1998 |

| Head Office | 10th Floor, Sterling Tower, 14 Poudriere St., Port Louis, Mauritius |

| Support Phone | +1 (650) 491-9997 |

The brokerage firm CG Invest, previously known as CGFX, is an international financial company with over 27 years of experience in trading and investments.

Founded allegedly in 1998, the company has evolved from a local broker in Jordan to a global operator with offices in Mauritius and Dubai. It is regulated by licenses from regulatory authorities in various jurisdictions, including Mauritius and the United Arab Emirates.

According to the developers' claims, the company provides access to over 1,200 investment instruments, uses modern MetaTrader 5 platforms, and ensures a high level of security and transparency for its clients. The main areas of activity include trading on financial markets, investment management, and social trading.

Account Registration on cginvest.com

To start working with CGInvest, you need to register on the official website cginvest.com. The registration process is simple and includes filling in personal details, verifying your identity, and choosing a trading account. After registration, users gain access to the trading platform, a demo account, and the option to make deposits to begin trading.

Available Markets and Trading Platform of CG Invest

The broker offers a wide range of trading instruments, including currency pairs, stocks, indices, commodities, and cryptocurrencies. Trading is conducted through the popular MetaTrader 5 platform, available for PC, Mac, iOS, and Android. The platform provides market execution of trades, a minimum lot size of 0.01, and support for automated trading algorithms. Additionally, the availability of copy trading and social trading features is claimed, allowing users to follow successful traders and copy their strategies.

Trading Accounts of the Broker CGInvest

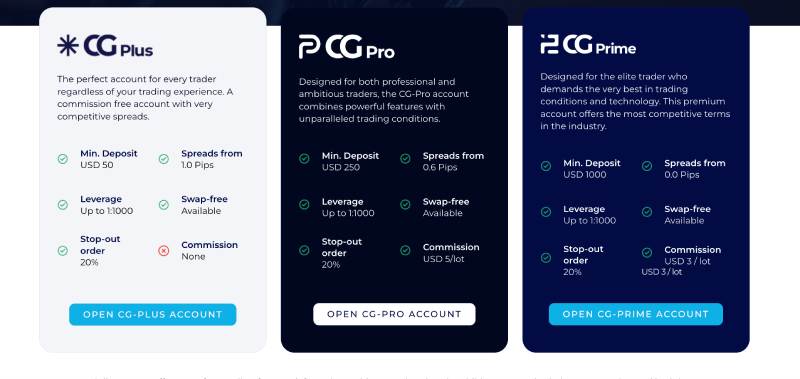

CG Invest offers several types of trading accounts to meet the needs of both novice market players and professional traders:

CG-Plus — minimum deposit of $50, spreads from 1.0 pip, leverage up to 1:1000, no commission.

CG-Pro — minimum deposit of $250, spreads from 0.6 pip, leverage up to 1:1000, $5 commission per lot.

CG-Prime — designed for experienced traders, minimum deposit of $1000, spreads from 0.0 pip, $3 commission per lot, leverage up to 1:1000.

All accounts provide swap-free trading during the first week, negative balance protection, and hedging.

Depositing Funds and Withdrawing Money from CG Invest

Deposits and withdrawals are carried out through convenient and secure methods:

bank transfers;

credit cards;

electronic wallets.

The processing procedures for deposit and withdrawal requests typically take a short time, and transaction security is ensured by modern protocols.

Brief Conclusion about CG Invest

CG Invest — a broker claiming to offer modern technologies, a wide range of instruments, and flexible trading conditions. The official website cginvest.com serves as a platform for registration, obtaining information about trading conditions, and starting successful trading on financial markets. However, before engaging with this broker, it is recommended to review their legal information and verify it further.

Frequently Asked Questions

The overwhelming majority of brokers are scammers. Traders can identify illegitimate ones by using free online resources. It is essential to verify the company's registration, the licensing of its services, and its operational history. It is also important to assess the completeness and authenticity of contact information and the transparency of trading conditions.

You can consult specialists who can help evaluate the broker and identify signs of fraud, and if necessary, assist in opening an account with a reliable service provider. A knowledgeable and comprehensive approach will help avoid negative trading experiences.

First and foremost, pay attention to the content of the comments. Excessively emotional opinions without specifics may indicate paid content. Additionally, a broker's positive reputation may be indicated by mass activity on a single online portal or forum. Another sign of fake reviews is their formulaic nature. Such comments are filled with general phrases and advertising slogans. Fraudulent projects use paid content to confuse traders and lure them into cooperation.

It is important not to fall for the tricks of company representatives. This can lead to additional financial losses. With legitimate brokers, withdrawing funds is a free service that is not subject to any fees such as insurance, taxes, commissions, etc.

If you need assistance in withdrawing capital, it is advisable to consult specialists. Timely consultation with experts can help achieve positive results and withdraw funds from the brokerage account.

In the case of scam brokers, account blocking may be related to a simple refusal to withdraw funds. Clients are accused of violating agreements, money laundering, technical work on the platform, etc. Such manipulations are aimed at depriving traders of the ability to withdraw capital.

When a brokerage account or personal account is blocked, it is better to use the services of professionals . Depending on the reason for the blockage, experts can find the optimal solution to the problem.

The reasons for the inactivity of a brokerage company's presentation portal can vary widely. Blocking due to numerous complaints, cessation of project activities, inclusion in the blacklist of trading platforms — all of this can lead to access issues to the broker's site. Additionally, unstable internet connection and browser restrictions can cause improper functioning of the resource.

If the official broker's website does not open, seek help from experts. They will advise on any questions and provide recommendations for further actions.

First and foremost, it is important to ensure that there are no assets in the account and no debts to the broker. If there are instruments in the investment portfolio, they should be sold, and you should wait for the settlements to be completed. After that, you can submit a request for the withdrawal of funds and the closure of the brokerage account.

If the broker refuses to fulfill requests, it is better to consult experts. They can assist in closing the brokerage account and recovering funds through chargebacks . When preparing to dispute transactions, it is necessary to gather all available evidence of cooperation with the project. This will help increase the chances of successfully initiating refunds.